The most innovative accounting app in Hungary

How can our app help you?

Watch the Proab app demo video:

The PROB app

Warns you about deadlines, tasks, news affecting you, limits

Shows you all the information that can help you make the right tax decisions

Gives you a clear overview of your business accounting tasks with the help of our accountants

Revolutionary features

See what features are available in our app and what improvements we are working on!

Basic function

Basic function

Basic function

If you have more than one business, you only need to register one account and you can manage them all from there.

Basic function

Basic function

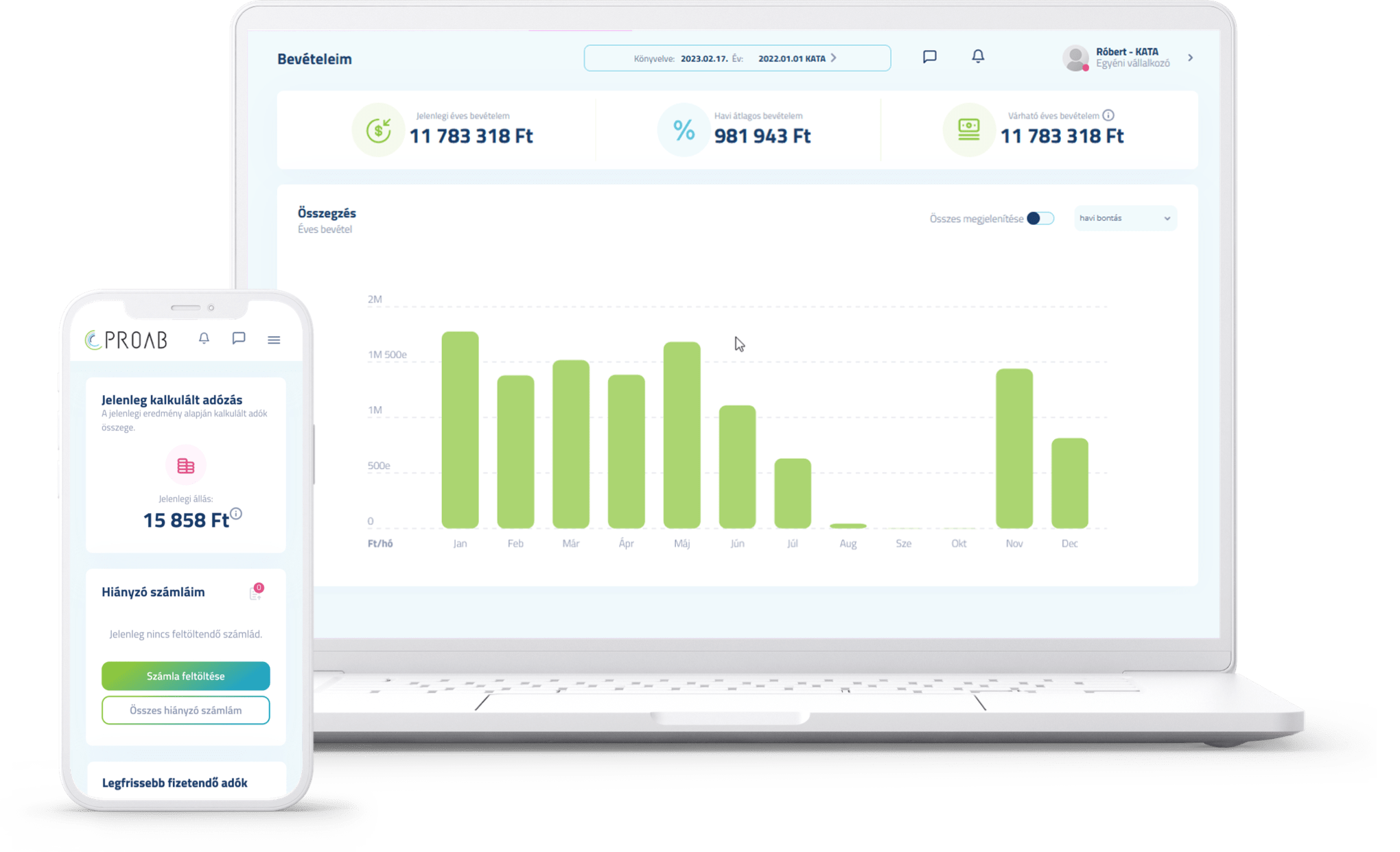

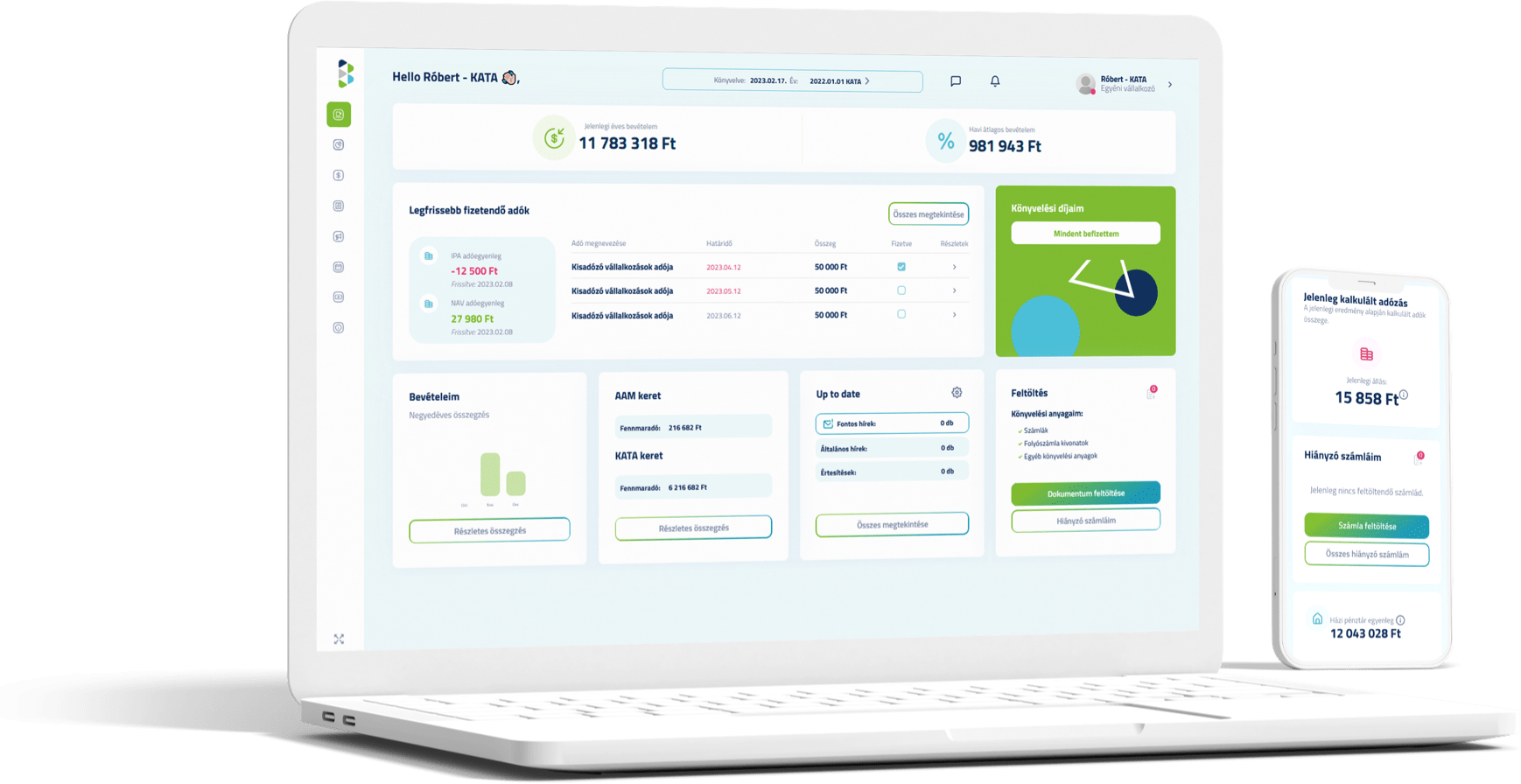

Dashboard menu

You can see the most important informations and functions in the Dashboard menu.

Basic function

Basic function

Subscription system

Our subscription system is designed to provide a convenient way to pay your accounting fees.

You only need to enter your card details once and from then on we will deduct the accounting fees from our clients every month. The security of the system is guaranteed by Barion, one of the largest payment solution providers.

Basic function

Basic function

Tax balances

We constantly show you your NAV and local business tax balances.

Basic function

Basic function

Current tax accounts

We always make the latest NAV and local business Tax tax flow statements available to you.

Basic function

Basic function

Taxes payable

You can receive notifications of all your tax obligations related to your business and see payment information.

Basic function

Basic function

Income data

We show you your company’s income on a monthly basis, aggregated for the tax year and a monthly average.

Basic function

Basic function

Established income for flat-rate taxpayers

We make available your company’s flat-rate income, on a monthly basis, aggregated for the tax year and a monthly average.

Basic function

Basic function

Output data

You can continuously monitor your company’s expenditure data, on a monthly basis, aggregated for the tax year, monthly average and by type.

Basic function

Basic function

Flat-rate tax limit

You can see your annual flat tax limit and how much is still available.

Basic function

Basic function

Tax exemption limit

We show you the annual limit for your tax exemption and how much is still available from it.

Basic function

Basic function

New KATA limit

You can monitor your new KATA annual allowance and how much is still available from it.

Basic function

Basic function

VAT detailer

In our application, you can see your VAT amounts payable or deductible on a monthly basis.

Basic function

Basic function

Expected VAT

For quarterly and annual VAT return filers, we show the expected VAT amount.

New function

New function

UP-TO-DATE news

We only send you tax news of interest and relevance to your business.

New function

New function

Upload accounting material

You can easily upload your accounting material, current account statements and receipt slips.

New function

New function

Upload missing invoices

We transparently indicate when an invoice is missing from your accounts and you can upload it quickly and easily.

Basic function

Basic function

Helpful information

You can find all your tax bank account numbers in one place.

Basic function

Basic function

Deadlines

You can see your company’s payment deadlines in one place.

Basic function

Basic function

Fixed assets

We show you your current fixed asset inventory and where you are in the depreciation process.

Basic function

Basic function

Balance sheet

We always make the latest balance sheet available for your company.

Basic function

Basic function

KIVA base

You can see the tax base of your KIVA company, constantly updated.

Coming soon

Coming soon

Notification of change

You can easily report all changes affecting your company and keep track of them transparently.

Coming soon

Coming soon

Multilingualism

Our application is not only available in Hungarian, but also in English, German, Italian, French and Spanish.

Coming soon

Coming soon

Client gateway / Company gateway messages

You can continuously see messages that arrive to your client gate and/or company gate.

Coming soon

Coming soon

Payroll tasks

No matter what kind of payroll work you have to do, you can manage the related tasks easily and simply.